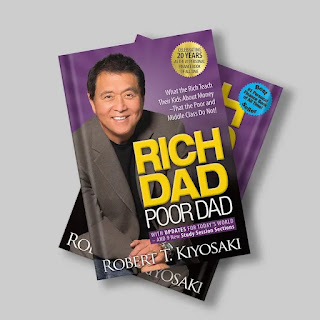

RICH DAD POOR DAD

In a world where financial literacy is crucial for success, Robert Kiyosaki's groundbreaking book, "Rich Dad Poor Dad," has captivated readers worldwide. Published over two decades ago, this personal finance classic remains as relevant as ever, offering valuable insights and a fresh perspective on wealth creation and financial independence. In this article, we delve into the essence of Rich Dad Poor Dad and explore why this book is a must-read for individuals seeking to enhance their financial intelligence and take control of their financial future.

The Tale of Two Fathers: At the core of Rich Dad Poor Dad is Kiyosaki's personal narrative, contrasting the mindsets and financial philosophies of his two fathers: his biological father (the "poor dad") and the father of his best friend (the "rich dad"). Through captivating anecdotes and real-life experiences, Kiyosaki shares the divergent lessons he learned from each father, highlighting the significant impact mindset and financial education have on achieving financial success.

Challenging Conventional Wisdom: One of the key reasons why everyone should read Rich Dad Poor Dad is its ability to challenge conventional wisdom and societal norms surrounding money. Kiyosaki questions traditional beliefs about wealth accumulation, debunking myths and shedding light on the importance of financial literacy, asset accumulation, and investing in income-generating assets rather than relying solely on a paycheck.

The Cash Flow Quadrant: The book introduces the Cash Flow Quadrant, a powerful framework categorizing individuals into four quadrants: Employee, Self-Employed, Business Owner, and Investor. Kiyosaki emphasizes the significance of transitioning from the left side of the quadrant (the Employee and Self-Employed) to the right side (the Business Owner and Investor) to achieve financial freedom and generate passive income.

Building Assets and Passive Income: Rich Dad Poor Dad stresses the value of building assets that generate passive income, such as real estate, stocks, and businesses. Kiyosaki underscores the importance of acquiring financial intelligence to identify opportunities, make sound investment decisions, and create sustainable income streams that enable individuals to escape the cycle of living paycheck to paycheck.

The Power of Financial Education: One of the most transformative aspects of Rich Dad Poor Dad is its emphasis on financial education. Kiyosaki advocates for individuals to continuously improve their financial intelligence by studying finance, investing, and entrepreneurship. By expanding their knowledge, individuals gain the confidence and skills necessary to make informed financial decisions and secure their financial future.

Taking Control of Your Financial Future: Rich Dad Poor Dad inspires readers to take control of their financial destiny and break free from the constraints of societal norms. Kiyosaki encourages individuals to embrace a mindset of financial independence, develop a plan, set goals, and take deliberate actions towards building wealth and achieving financial freedom.

Conclusion: In a world where financial literacy is often overlooked, Rich Dad Poor Dad stands as a beacon of financial wisdom and empowerment. Through personal stories, thought-provoking concepts, and actionable advice, Robert Kiyosaki provides readers with the tools and knowledge needed to challenge conventional beliefs about money and pave their own path to financial success. Regardless of your financial background, reading Rich Dad Poor Dad is a transformative experience that can spark a paradigm shift in your mindset, ignite your entrepreneurial spirit, and guide you towards a prosperous and fulfilling financial future.

.jpeg)

0 Comments